Driving manufacturing – The UK’s thriving component industry can ensure British automotive plants won’t stall in a no-deal Brexit

UK automotive manufacturers needn’t fear being hit by unexpected delays or new tariffs imposed on EU-sourced components following a hard Brexit, argues B.G. Bullas Managing Director, Nathalie Wheeldon.

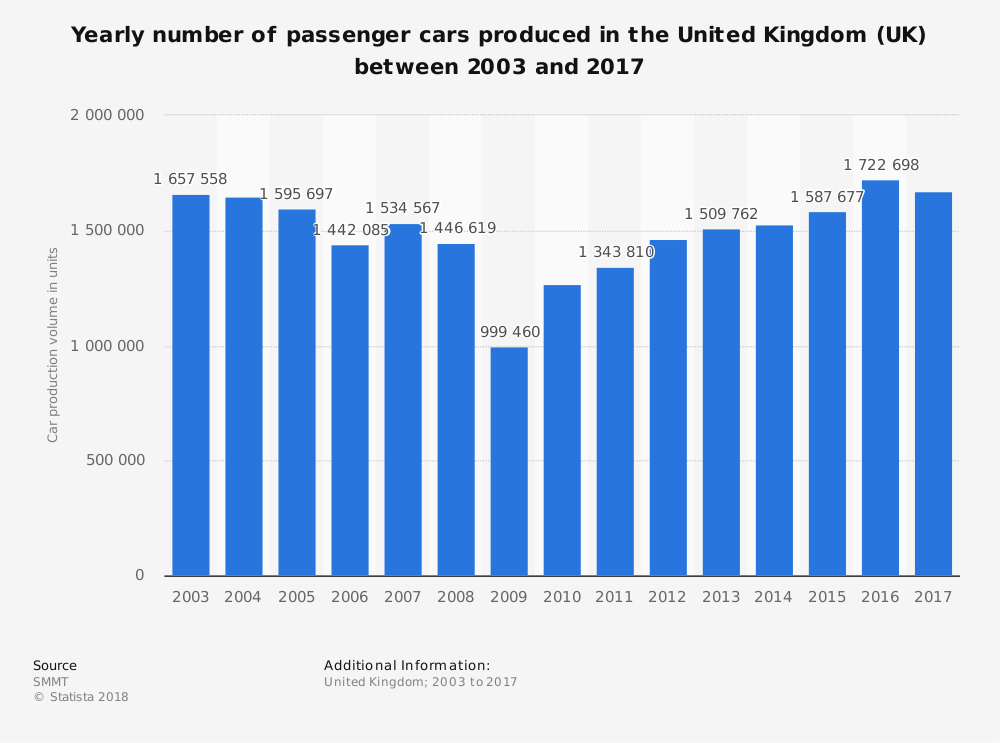

Britain’s automotive manufacturing industry is a vital part of UK PLC. And British car manufacturers from Jaguar Land-Rover to Toyota are naturally concerned a no-deal Brexit will mean significant extra expense in terms of new tariffs on parts, and delays in manufacturing caused by vital components being held-up at Customs.

Of course, any delay in production lines represents a huge cost to automotive manufacturers. It’s small wonder that many automotive industry bosses are becoming increasingly vocal in their concern over the future of the industry in a post-Brexit Britain.

However, there is perhaps one element of the manufacturing supply chain that has been overlooked as a potential alternative source of components. The UK itself has a wealth of experienced and skilled component manufacturers able to meet the needs of UK automotive manufacturers should there be a no-deal Brexit.

It’s not surprising that UK vehicle manufacturers are concerned about the impact of a no-deal Brexit on vital supply chains. Honda recently warned the Government that a single 15-minute delay in production at its UK Swindon plant could add £850,000 in costs, such are the strict just-in-time methods today’s automotive manufacturers practice. And Jaguar Land-Rover’s Chief Executive, Dr Ralf Speth, told a conference this summer that: “We are dependent on just-in-time processes and any friction at our borders could mean stopping production at a cost of £60m a day.”’

Ford’s European boss, Steven Armstrong, has gone so far as declaring a no deal Brexit ‘would be pretty disastrous’, according to The Chartered Institute of Logistics & Transport.

But there is an alternative source of quality components that offers a solution for manufacturers facing hugely costly production delays. Britain has a significant number of expert component manufacturers able to step-up and work with automotive companies to ensure a consistent supply of key parts.

Of course, many British plants and component suppliers are already deeply embedded in automotive supply chains. Don’t think for a moment Honda or Toyota are simply using UK plants simply for final assembly. Companies such as BMW-Mini generate wealth and jobs across many British suppliers.

But these are long established relationships, built into the structure of production plans. The resource that’s perhaps not being fully exploited is the wealth of other UK component manufacturers who are a perhaps a little smaller in scale, but still entirely capable of producing faultless high-quality components.

Of course, this isn’t a resource that could be tapped at a moment’s notice. But now is the time for UK car plants to be at least reaching out and exploring the capabilities of this significant alternative source.

Successful manufacturers acknowledge complete dependence on one supplier or one factory for vital components is a mistake, and in the era of the global supply chain we have become used to multi-sourcing from across the world. As a safeguard, the British motor industry might consider sourcing some of their stocks of more vital components far closer to home.

It’s now become an industry legend how, following the terrible Japanese earthquake and tsunami of 201l, suddenly there were no more black cars available. Toyota, BMW, GM and Ford – who ironically many moons ago proclaimed ‘you can have any colour you like, as long as it’s black’ – were all reliant on a particular pigment, Xirallic, for their black paints. That pigment was only sourced from one Japanese plant in Onahama, which was damaged by the tsunami and exposed to radiation from the Fukashima nuclear reactor.

Relying on one single source in automotive manufacturing can certainly leave the future looking black if that supply fails. Any key components with a single source will always prove the weakest link in any global supply chain. Having the capacity to source components from alternative suppliers, such as Britain’s highly skilled and long-established manufacturing base, is surely an option that needs to be considered by everyone; from specialist producers such as Morgan, to high-volume manufacturers like Nissan and Honda.

The Council of Supply Chain Management Professionals says an unexpected parts shipment delay that causes an auto assembly plant shutdown can cost over £15,000 ($20,000) per minute. With these figures in mind, of course Britain’s automotive manufacturers are naturally extremely concerned about any potential delays at Customs to vital components. Now is the time for UK-based automotive companies to forge new relationships with Britain’s expert component manufacturers; and work together with them to formulate plans to offset the worst effects of a no-deal Brexit.

The UK has a wealth of talent able to meet the demand if EU-sourced automotive components become uneconomical, or there are delays in vital component deliveries. As an example, B.G. Bullas itself is ISO 14000 certified and has extensive experience working in lean manufacturing supply chains. We can manufacturer high quantities of items from seals to heat proof engine components such as hoses.

I’m proud that I’m the granddaughter of BG Bullas’ founder, Basil ’Bob’ Bullas. The company has remained in our family’s hands for 55 years. We’ve a lot of tradition and pride; but also lead the way in terms of many of our extrusion moulding processes. And we are merely the tip of the iceberg, just one of many such specialist manufacturers across the country that have built up their expertise over many decades.

Now is the time for British automotive manufacturers working in car, bus and truck manufacturing to build relationships with the wealth of long-established, skilled UK-based component companies, to ensure the continued supply of essential, tariff-free components.

And I’m confident that the UK’s many skilled component suppliers can help stop the mass exodus of vehicle manufacturers threatened if there is a no-deal Brexit.

Britain’s car manufacturers face many challenges today. For example, the sudden dash from diesel has left Jaguar introducing a three-day week; only last year it was selling record volumes. And it’s concerning to note its new electric model, the IPace, Jaguar’s answer to the diesel crisis, is its one model not produced in the UK; but in Austria, at the heart of the EU.

What the industry doesn’t need is a whole host of new problems on top of this come Brexit. It’s no accident Reuters recently revealed BMW is proposing a scheduled halt in production immediately following Brexit implementation. It’s clearly concerned about the impact on production.

Of course, everyone hopes that the UK’s EU border remains frictionless, with no new tariffs or Customs clearance requirements. But the UK’s automotive industry’s £82billion turnover is a vital part of the nation’s economy. Those manufacturers committing themselves to retaining production in the UK will help safeguard their production lines against a no-deal Brexit by developing new ties with Britain’s many quality components suppliers.

Again, just as one example, Bullas may have been in business for 55 years, but we are still at the cutting edge of plastics manufacturing, producing bespoke in-house designed automotive components and parts. A number of our most skilled workers have been with us for over 20 years; yet we are also at the vanguard of CAD/Cam design software.

There’s no doubt Brexit represents a significant potential threat to British manufacturers with global supply chains; but looking closer to home to supplement existing component suppliers surely makes sense as we face up to the ‘Deal- No Deal’ challenge.